Use Two-Factor Authentication

- Passwords alone are no longer enough to protect our information and

accounts.

- Two-factor authentication hugely improves your security while causing

minimal inconvenience for you.

- It typically uses time-limited codes – found in an app on your phone –

or a request for approval on another of your devices.

- Two-factor authentication (2FA), two-step verification (2SV) and

multi-factor authentication (MFA) all refer to the same thing.

The problem with passwords

For many years we’ve used passwords to prove our identity when logging into

apps and websites. The idea is, of course, that since your passwords are

known only to you, your accounts and data are kept private.

And this remains generally true: in order for someone else to get into one

of your accounts, they’d need to know your password. The trouble is, this

isn’t as unlikely as you might think.

As you learned in the previous chapter, the secrecy of a password can be

compromised in several ways:

- You might be tricked into disclosing it by phishing. That’s where you

receive a message that appears to be from a service you trust, but is

actually fake, and leads you to a fake page that asks for your password

and sends it to the criminal responsible (for more on phishing, see

Recognise Social Engineering).

- Someone might guess it or, more likely, use software that automatically

makes millions of guesses until one is correct.

- It might be leaked in a data breach. That’s where someone breaks into a

company’s customer database and makes a copy of it, possibly publishing it

for others to find (see Accept That Data Breaches

Happen).

- A kind of malware called a keylogger might end up on

your computer. It records everything you type, including passwords. To

learn how to avoid malware, see Only Open

Trusted Apps and Files.

So, as we depend increasingly on online transactions, and store more of our

data in the cloud, the idea of only a humble password standing between

hackers and our private information is worrying.

In summary, it’s not that passwords don’t do what they’re meant to — it’s

that the chance of a stranger obtaining one of your passwords, and the

consequences if they do, create an unacceptable risk.

Second factors

With two-factor authentication (2FA) in place, your

password is only half of what you need to log into an account. You also need

a second factor, such as:

- A code displayed in an app, typically on your phone.

- A code received in a text message (SMS) or email.

- A code read to you by a computerised voice that calls you.

- A prompt on another computer, tablet or phone that’s already logged

into the account.

- A small gadget, like a memory stick, that plugs into a USB port.

Logging in with two-factor authentication

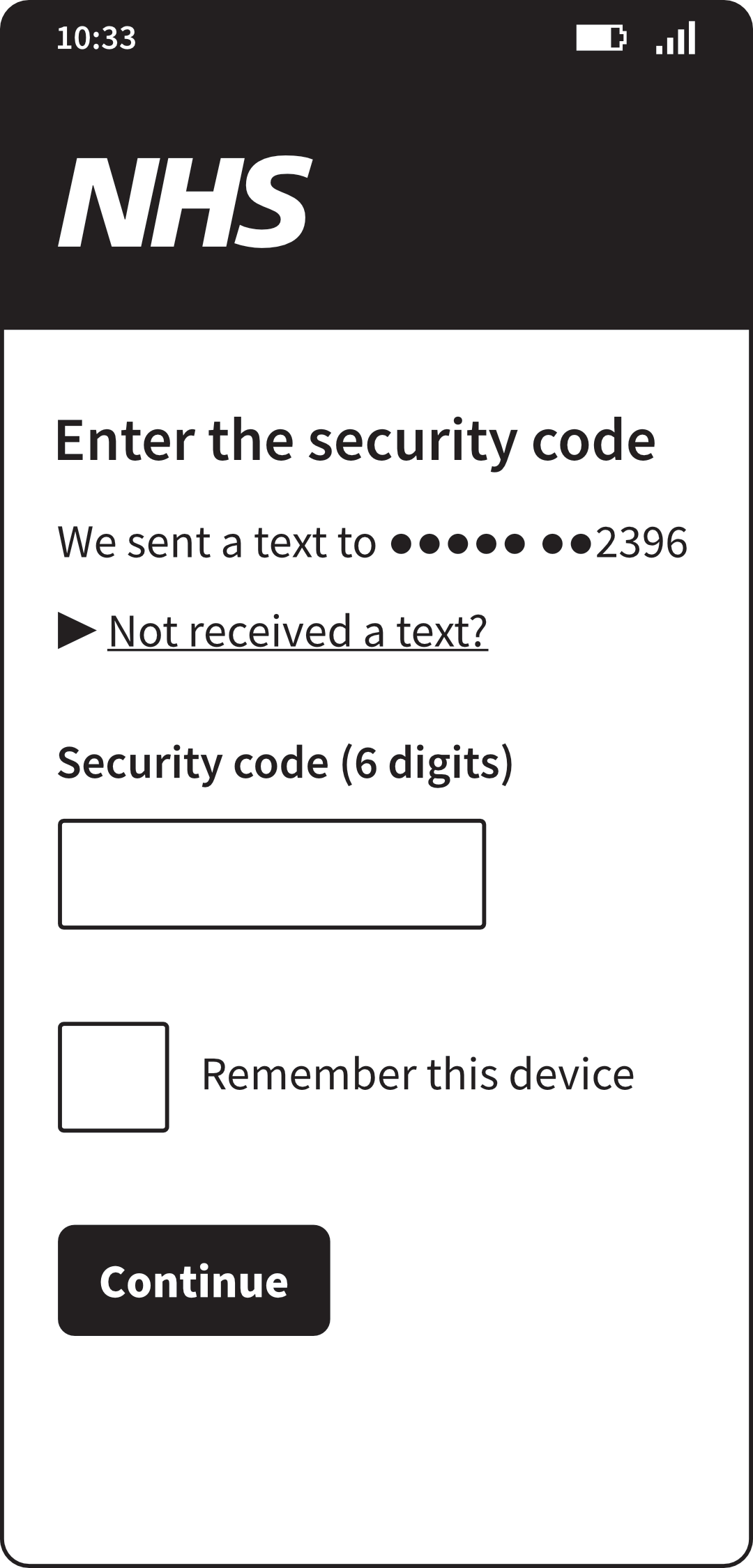

Logging in with two-factor authentication

Each of these has advantages and disadvantages. For example, text messages

are really easy, but sometimes you’re in a place where you can’t get a phone

signal; and in rare cases, they can be intercepted. A USB device works

anywhere, but is tiny and easy to lose if you’re not careful.

Authenticator apps

A good balance of usability and security can be had with an app on your

smartphone called an authenticator:

- It generates codes internally, so it works even without signal.

- You most likely already have a phone, so there’s no new expense.

- If you lose your phone, a stranger can’t use it because they don’t have

your PIN, fingerprint or face.

Choosing an app

Many authenticator apps are available, but you only need one because almost

all websites use a common standard. For example, Microsoft Authenticator

isn’t limited to making codes for your Microsoft account: you can add your

Google account too, and others like Amazon and Facebook. Equally, Google

Authenticator can make codes for your Microsoft account and more.

Setting it up

Adding your various accounts to your authenticator app can be quite

tedious, so I recommend doing it over a period of days or weeks. Your email

and social media accounts are most important, because they’re valuable

prizes for hackers, so do those first:

- Visit the website on another device, like a computer or tablet, and find

the page for managing your account. The link is typically in the top-right

corner, with an icon of a person’s head, the initial of your name, or your

profile picture.

- Find the option to turn on two-factor authentication. It should be under

a heading like ‘security’ or ‘sign-in options’. Some websites call it

two-step verification (2SV) or multi-factor authentication (MFA).

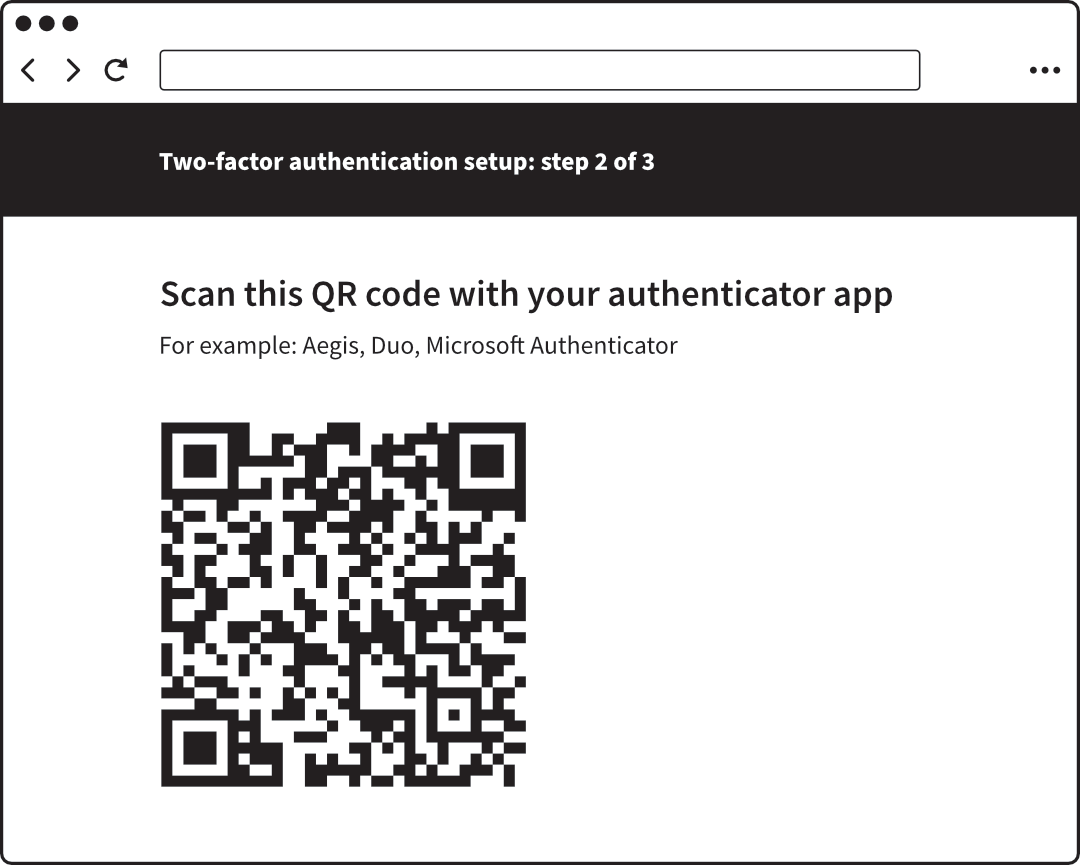

- Choose the option to use an app, and the website will show a QR code. In

the authenticator app on your phone, go to add an account, and scan the QR

code with your phone’s camera.

- A short numeric code appears on your phone, and the website (on your

computer or tablet) asks you for it. Type the code into the space provided

to confirm that the account is working with your authenticator.

A website showing a QR code to scan with a mobile phone to set

up two-factor authentication

A website showing a QR code to scan with a mobile phone to set

up two-factor authentication

Logging in

When you return to log in the same website in future, it will first request

your password as normal. Then it will ask for the code currently displayed

in your authenticator. This changes periodically, usually every thirty

seconds.

The code must be used within a certain amount of time – though there’s a

leeway after it changes, if you haven’t finished typing it – and each code

can be used only once. In fact, its proper name is a

one-time password (OTP) or one-time

passcode.

Authenticator app with three accounts configured

Authenticator app with three accounts configured

Authenticator apps generate codes mathematically based on the

current date and time and a longer, pre-agreed secret that was passed from

the website to your phone via the QR code. To allow for inaccurate clocks,

it usually doesn’t matter if you enter a code that’s very recently lapsed

or, if your clock is fast, one that’s been generated a bit early.

Trusted devices

A site may offer to remember or ‘trust’ your particular computer, tablet or

phone so you don’t suffer the inconvenience of two-factor authentication

every time you log in. In fact, on a device used only by you, there’s no

need to ever log out of your email or other accounts — provided the device

itself is locked with a password or PIN when unattended.

So it may be the case that you rarely get asked for an OTP. Your account is

still protected, and if someone tried to break into it from a

different device, they’d be thwarted by the two-factor

authentication — even if they knew your password. This is the ideal kind of

security: minimum fuss for you, and maximum frustration for criminals.

Another benefit of trusted devices is that you can sometimes use one to

authenticate another. For example, if your phone runs the Android operating

system and you also buy an Android tablet, the phone might show a question

like ‘Are you trying to sign into a tablet right now?’ and you can choose

‘Yes, it's me’, skipping the need for an OTP or even your password.

Alternative second factors

Not everyone has a smartphone, and it’s likely that for the foreseeable

future most services will continue to offer text message or phone call

verification as a second factor.

In fact, even when you do use an authenticator, it’s common to register

your phone number with a website so that if your app is unavailable you can

still perform two-factor authentication. The principle is the same, but the

OTP is sent to you via text message or read to you in a voice call.

Recovery codes

As a final precaution against getting locked out of your own account, many

services also offer a printable recovery code or codes. Keep these safe with

other important paperwork, so you know where to find them in the hopefully

unlikely event that you lose your phone and can’t get an OTP via any

method.

What you can do

- Enable two-factor authentication on your email account. It’s your most

important account, because not only does it contain a great deal of

information about you, but a stranger with access to your email can in

turn gain access to your other accounts via their ‘forgotten password’

facility.

- Ideally, enable two-factor authentication on social media and other

accounts that offer it.

- Don’t rely on just one second factor, especially for important accounts.

If possible, register multiple phone numbers as well as an authenticator

app. You could use the phone number of a close friend or family member —

but check with them first, and note that they’ll need to be present to

receive an OTP during the registration.